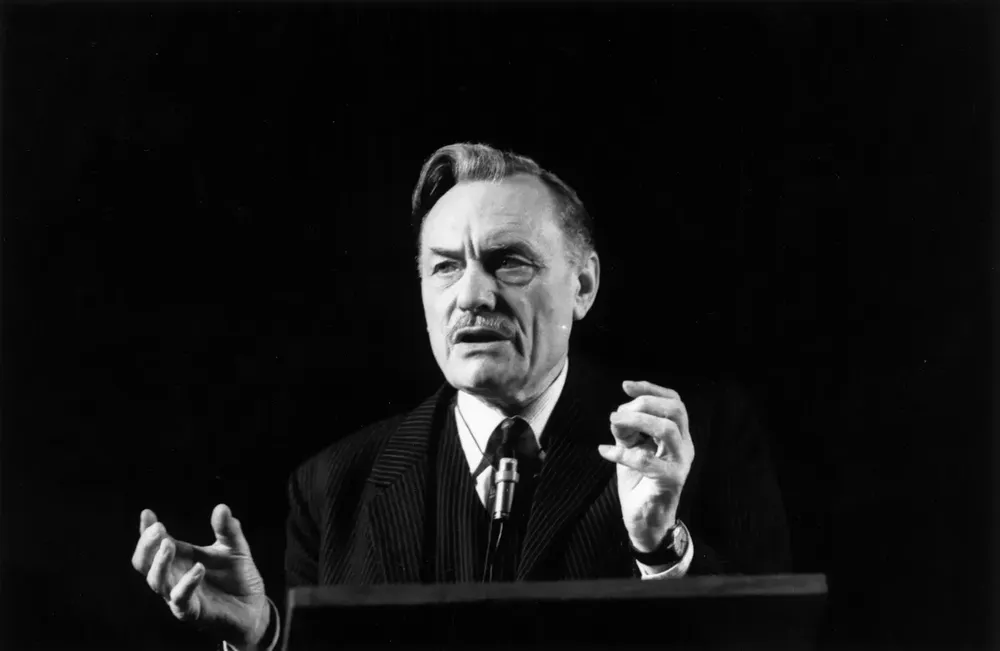

Jeremy Hunt channels Enoch Powell

The latest rumour going around Whitehall is that Jeremy Hunt might favour converting National Insurance into a specific NHS tax – or at least devoting more of it to funding health, an idea being kicked around by some MPs.

In doing so, the Health Secretary is, perhaps unwittingly, channelling none other than Enoch Powell. While Powell is mostly remembered these days for his infamous “rivers of blood” speech, the 50th anniversary of which just passed, he was also one of the most influential health ministers in British history.

Whether this was for good or for ill is still a matter of debate, but Powell certainly transformed the service, and the way it was paid for.

Here’s the potted history. When Powell took over as Health Secretary in 1960, the NHS was facing one of its many funding crises (yes, ’twas ever thus). His response, to the horror of the public, was to raise various charges, including doubling prescription charges. He was accused of trying to privatise the NHS by stealth (yes, that too) and was lambasted in the Commons. He also pushed to ensure that more NHS spending was paid for out of National Insurance.

You can get a sense of the impact by looking at the chart below. Back in the very earliest days of the NHS, the service was paid for entirely out of general taxation. That changed within a few years, when Labour was forced to introduce prescription charges and limit the kinds of services that were offered free. When he took control, Powell lifted those patient charges dramatically, including doubling prescription charges. Overall, patient charges leapt up to around 5% of spending. He also dug deep into the National Insurance budget, such that NI soon accounted for around 13.6% of the total NHS budget.

Interestingly, perhaps, the most controversial of Powell’s reforms – the increase in patient charges – barely lasted. Over the years, his successors allowed inflation to effectively erode the amount of the NHS budget coming from patient charges. In one sense, the NHS has been de-privatised since 1960, rather than privatised. These days barely more than 1% of the total NHS budget comes directly from patients in the form of charges.

Powell’s real legacy was to turn National Insurance into a permanent means of funding the health service. Indeed, even today it makes up around 17% of total spending.

Why does this matter? Why make a distinction between funding the NHS out of general taxation or national insurance? The short answer is that NI isn’t levied in the same way as general taxes. Indeed, because it’s a flatter charge that doesn’t increase as one earns more and excludes some taxpayers, it actually ends up hitting the less well-off the hardest.

This is one important objection to those calling to turn NI into a specific hypothecated tax (a tax devoted entirely to one purpose): the burden would fall increasingly on the poor. Indeed, by putting more of it into health, Powell was accused by his cabinet colleagues of turning National Insurance into a “hypothecated, regressive poll tax.”

This is hardly the only criticism of establishing a specific NHS tax. The Chancellor himself is unconvinced, arguing that such taxes are also vulnerable to recessions: what happens if the economy sinks and NI contributions fall? Does this mean less NHS spending. But others point out the survey results that suggest Britons would be happy to pay a bit more in tax provided it went into the health service.

But as I laid out in a Times column a while back, such ideas are only crazy until they’re suddenly not. At some point we have to work out how to fund the NHS and averting future winter crises. It seems likely that the answer will partly lie in higher taxes.

PS this blog leaned heavily on Nick Timmins’ brilliant history of the welfare state, The Five Giants. Highly recommended. And the Kindle version is cheap as chips.

Comments ()